In my life I have written several short autobiographies . Three were school related; one for high school creative writing, one for entry into Long Beach State College, and one for transfer to UC Santa Barbara. I have only the draft copies of these. I also presented myself through my resume and several bio’s for conferences and web sites.

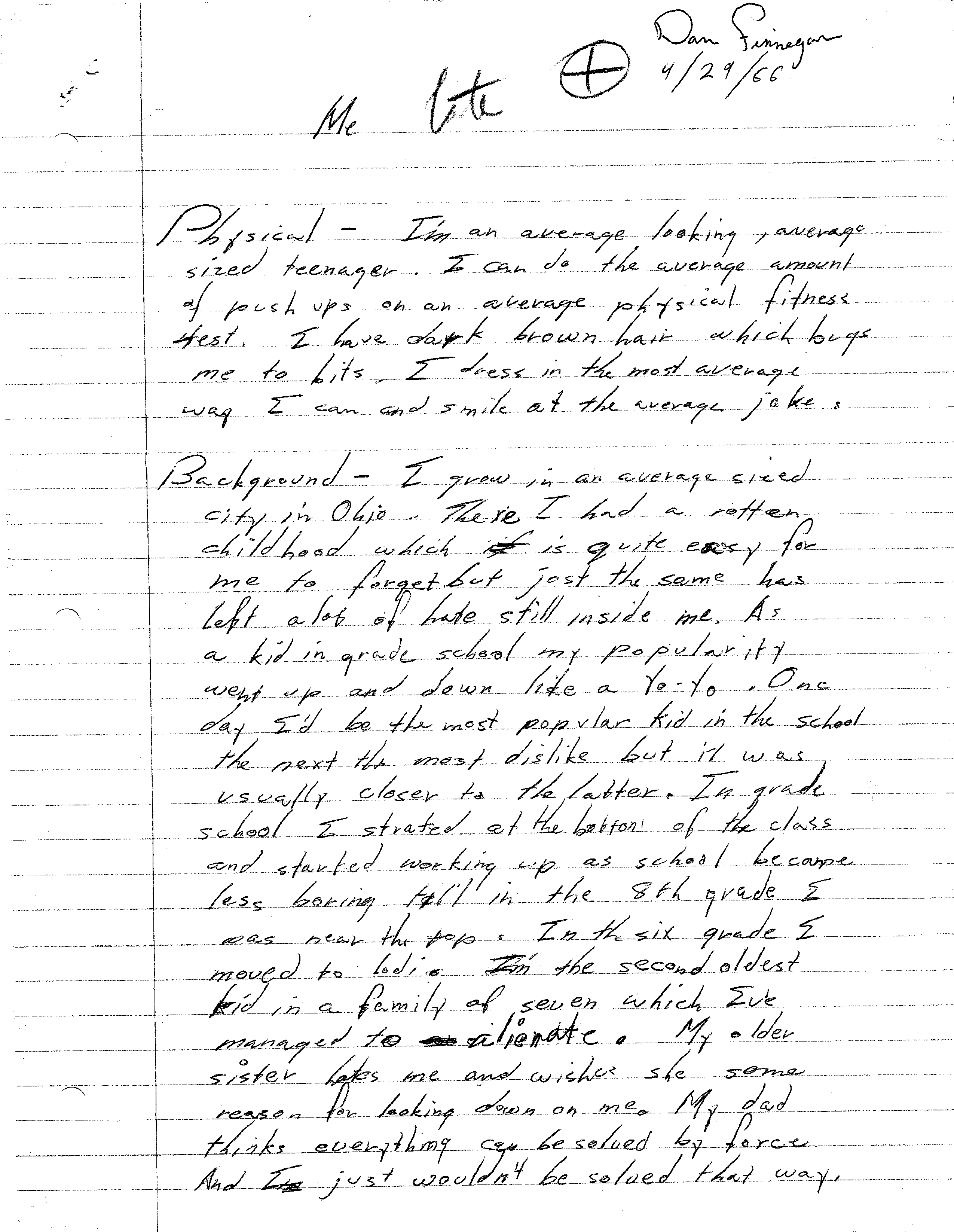

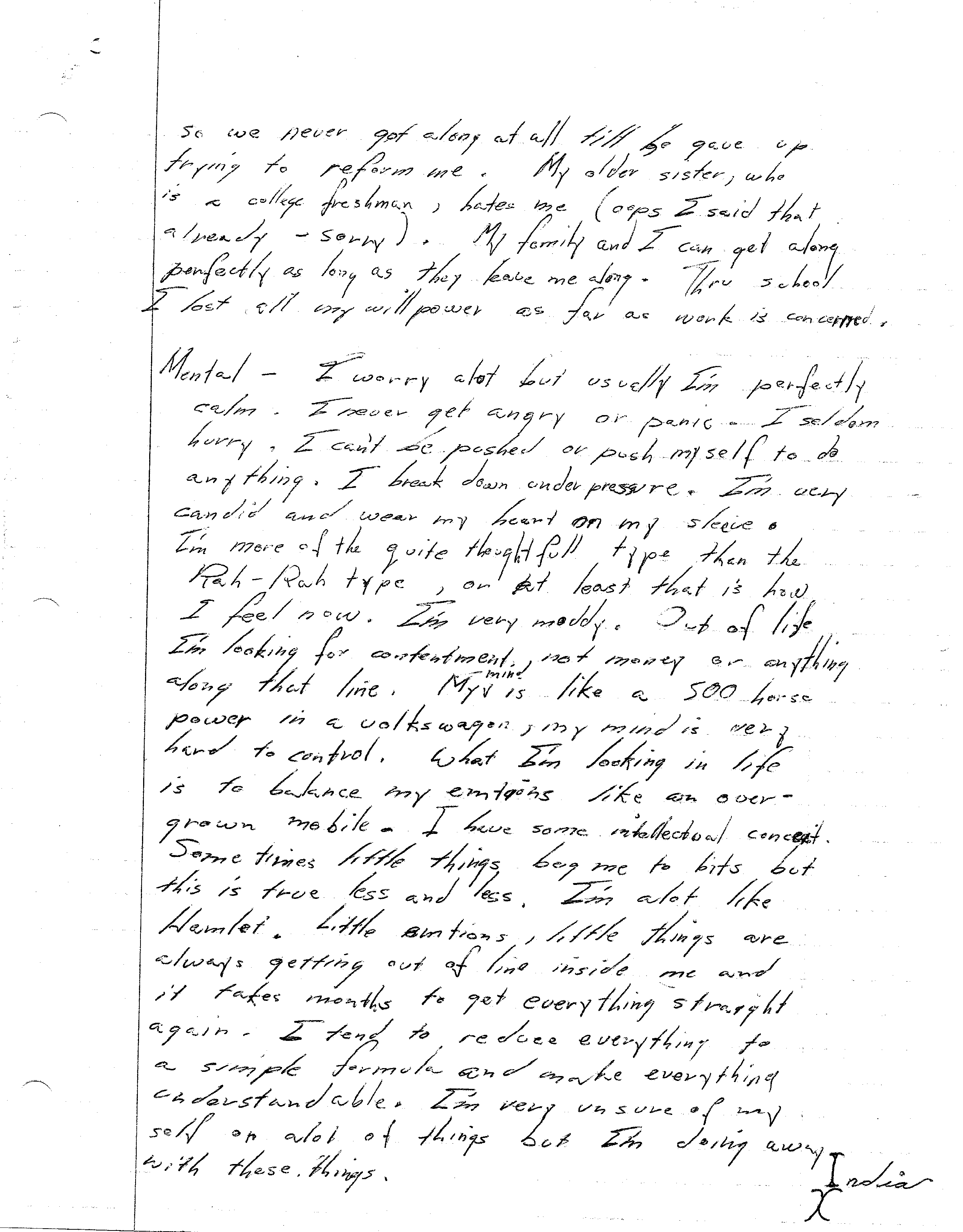

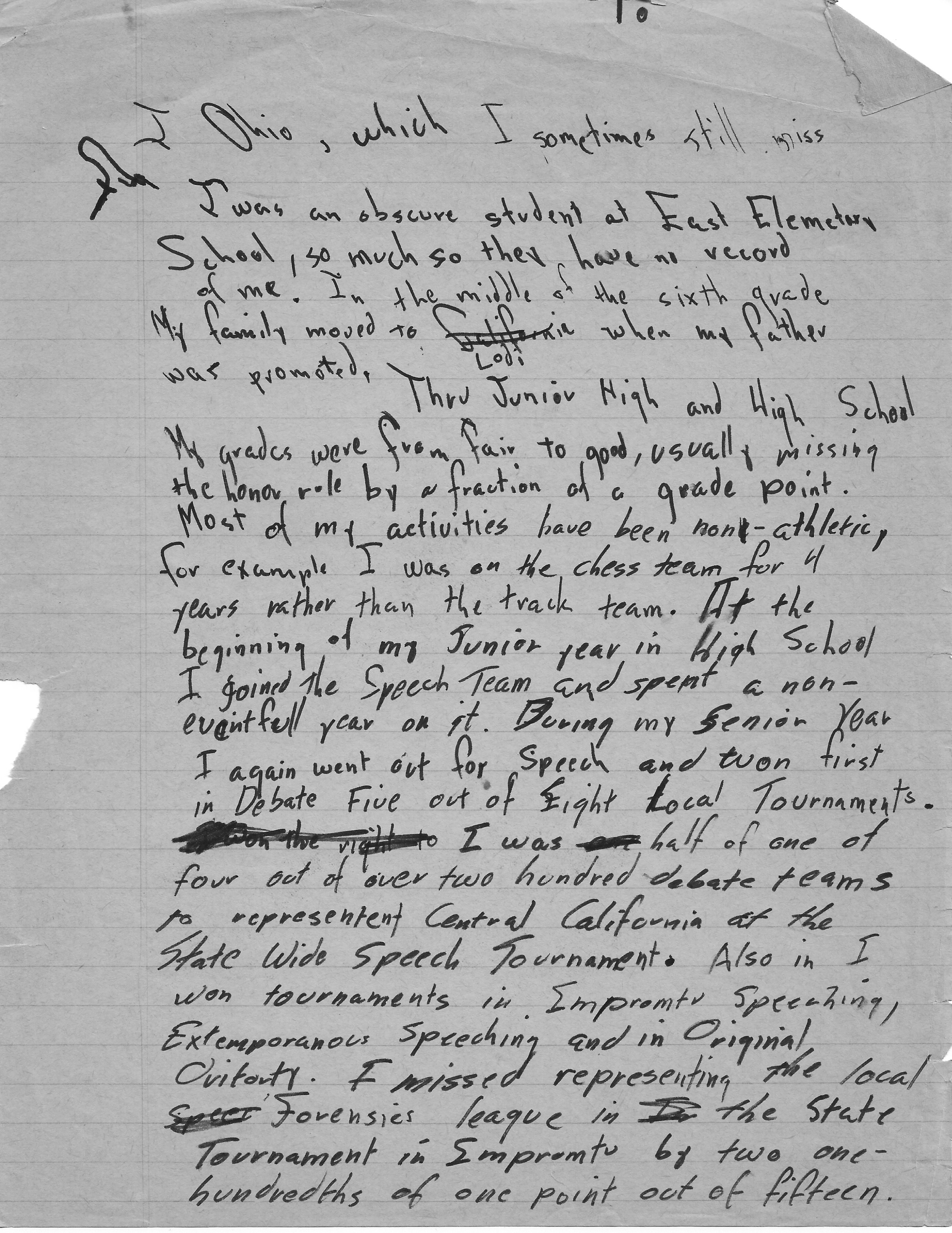

High School Creative Writing Bio

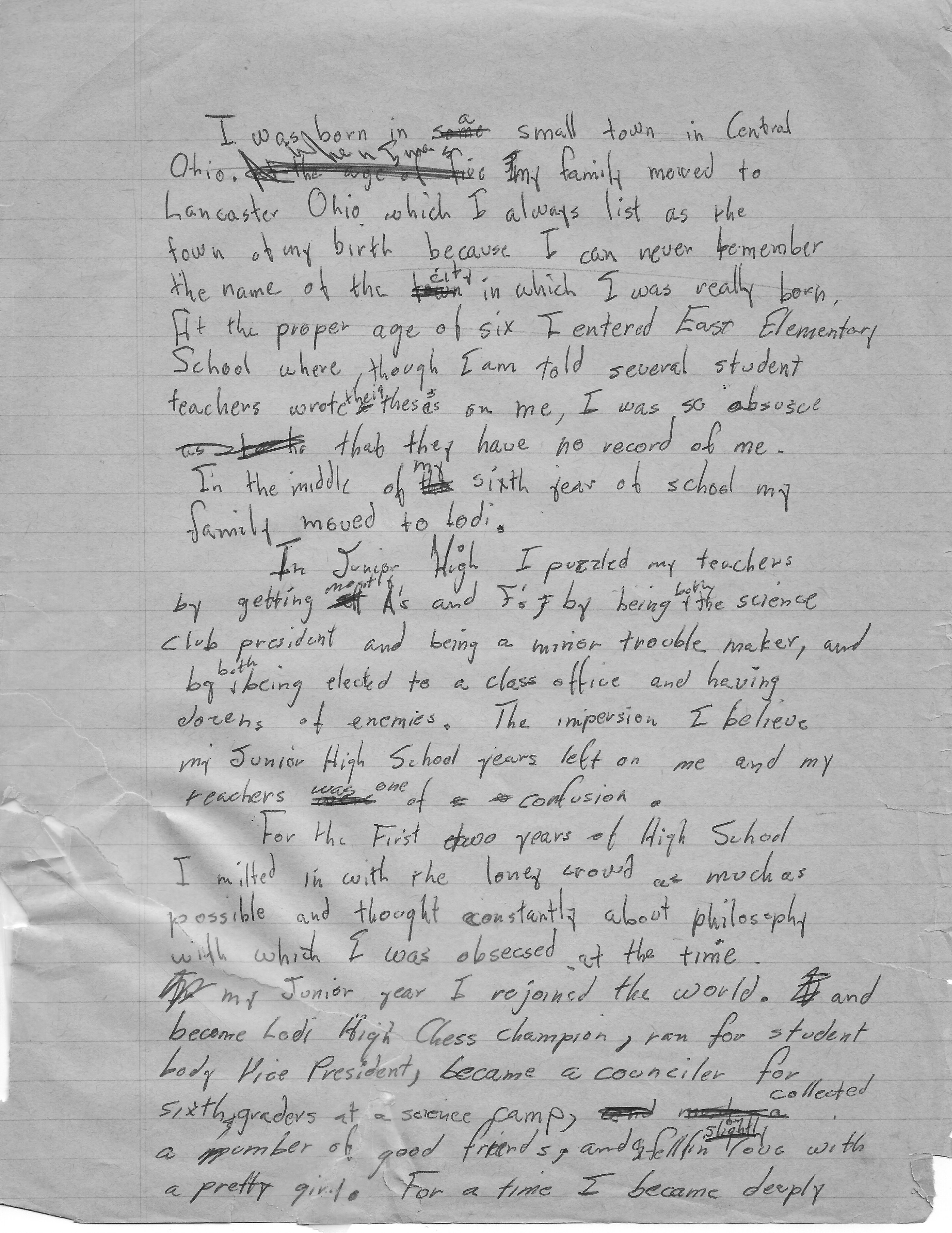

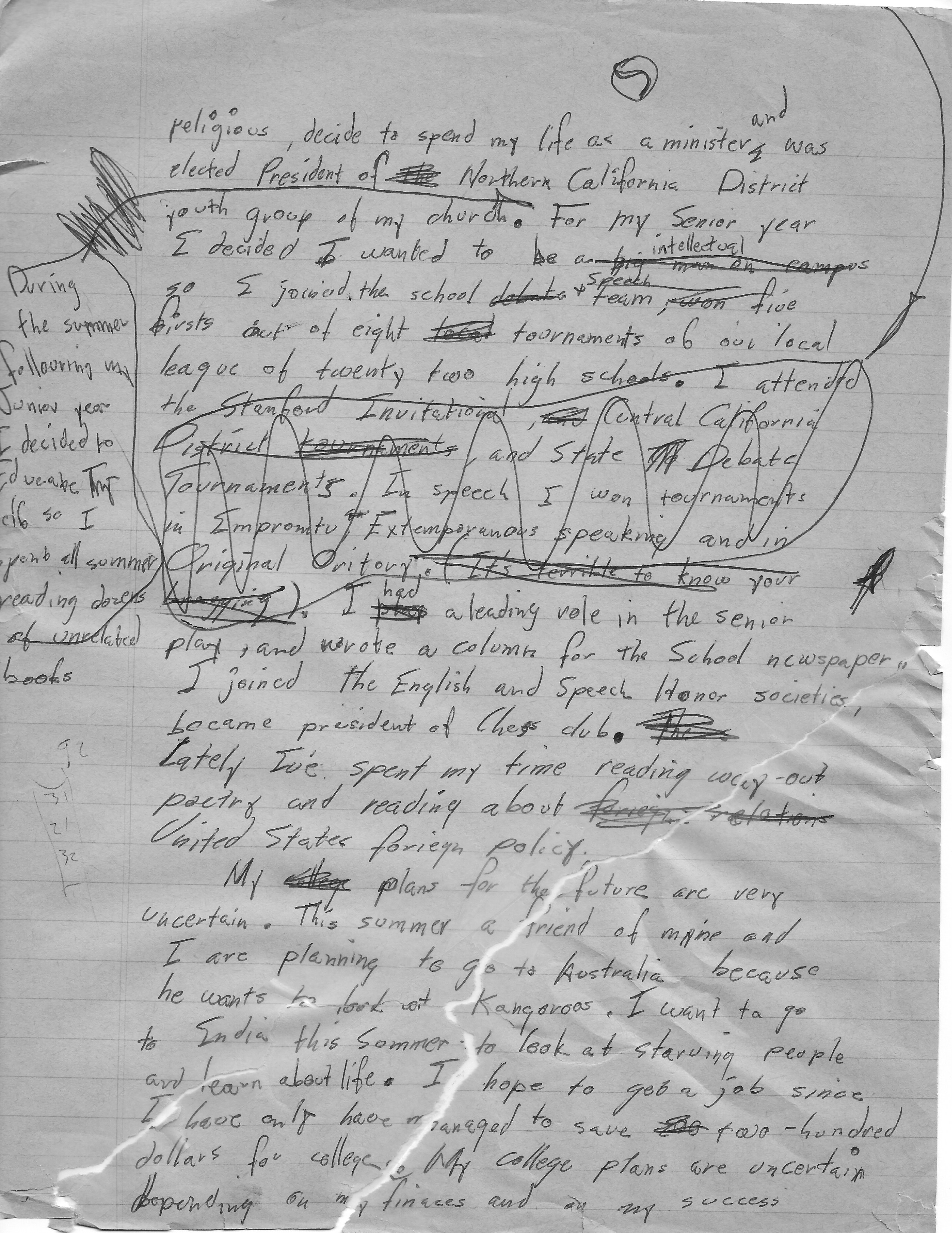

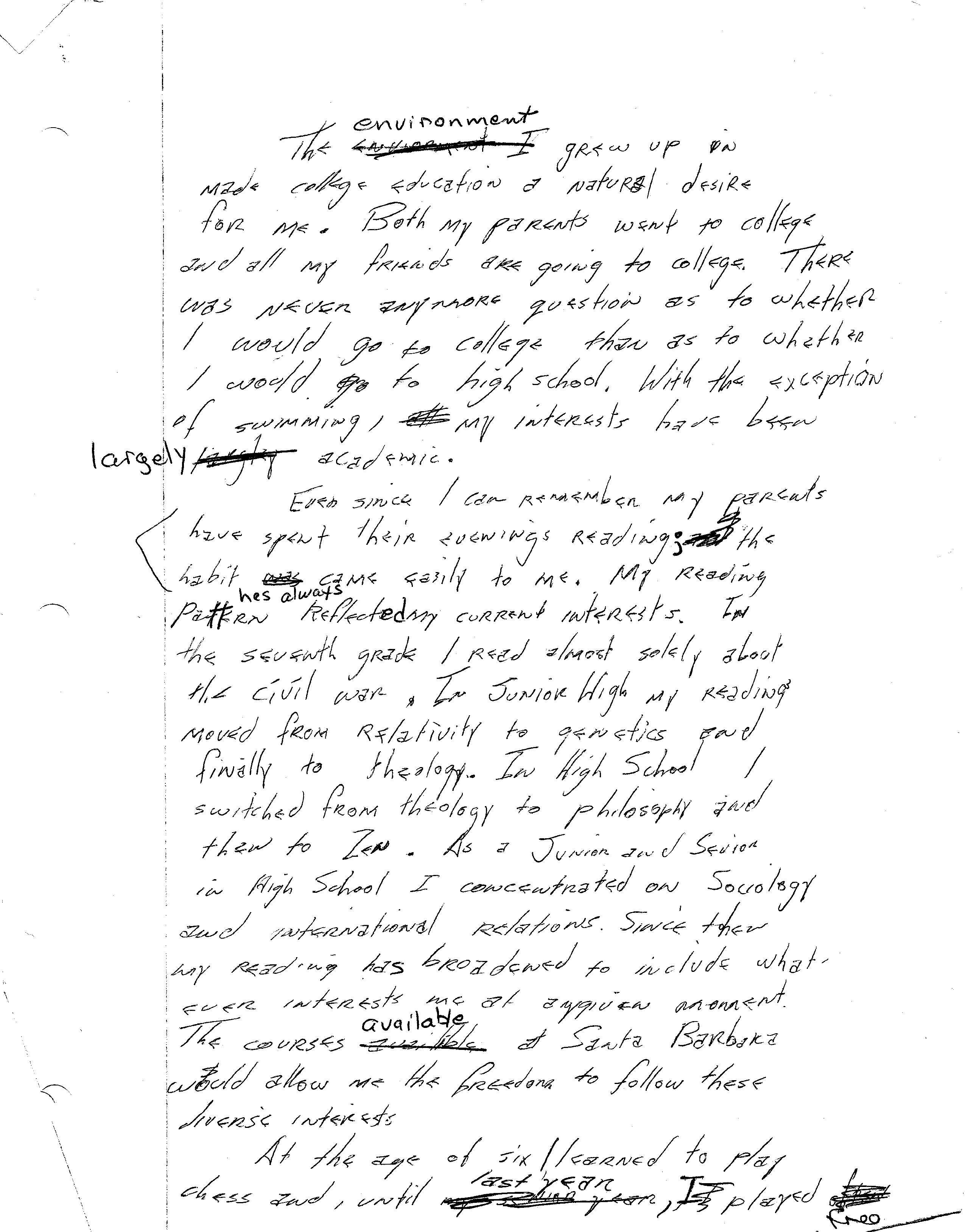

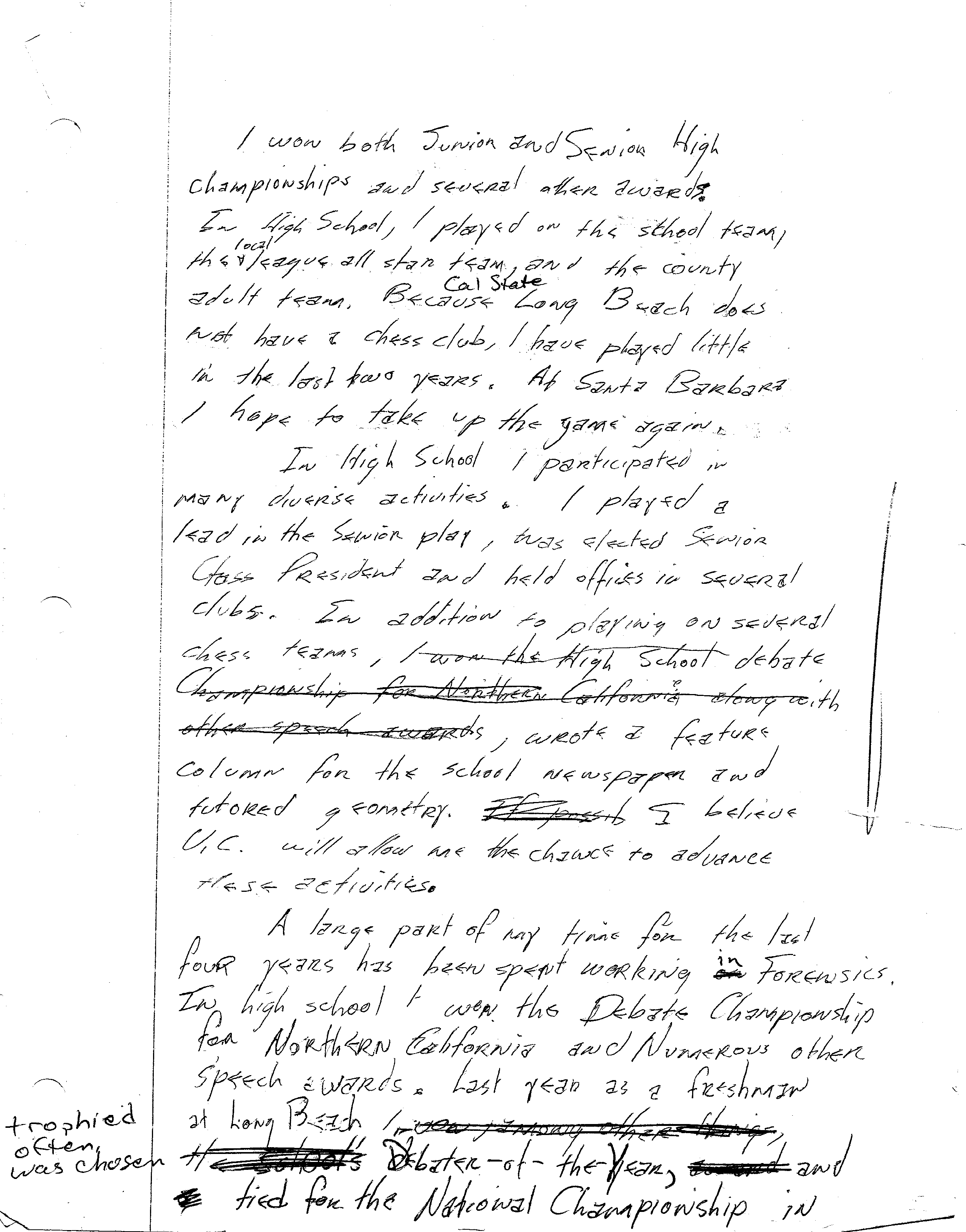

Long Beach State Application Drafts

Santa Barbara Bio

Fantasy Version of Self

I am recording a version of the summary story I tell myself about myself. This version was mentally written in advance of my 50th high school reunion. I will not recite this to anyone but myself:

After high school I left a great need to be going. I had to be out of my parents home, I had to be out of Lodi. I saw so many opportunities in the world: the counter culture movement, the anti-war movement, women, travel, invention of a whole new self. That great urge to be going has served me well.

I have lived in black American ghettos, in a tower overlooking Hong Kong, in a penthouse on San Francisco’s Nob Hill, in a Buddhist monastery in Thailand, in a renaissance villa in Provence.

I have worked as a farm laborer, as a janitor, as member of the graduate faculty of UC Berkeley, as a senior advisor to the Office of the President, and as the founder and president of three successful technology firms. I have been at home cutting deals with venture capitalists, delivering keynote speeches at international conferences, teaching advanced seminars on mathematical modeling, attending the opera in Vienna, and taking a local bus across Rwanda. I have been very poor and very rich.

I have made love to beautiful women, married, raised a family, and am now a doting grandfather. I have a close and loving marriage and family.

I have made a difference in the world. I have invented new technologies and mathematics. I have tracked-down criminal gangs from Vancouver to Saigon. I have saved American taxpayers and insurance policy holders billions of dollars from preventing and defeating fraud. I played a key role in facilitating the passage of the Americans with Disabilities act thereby improving the lives of millions. I have founded businesses and created good jobs.

I have experienced life. I have ballooned over the Alps, trekked the glaciers of Patagonia and the sand dunes of Namibia, tracked leopards in Botswana, sailed the lesser Sunday islands and an America’s Cup class boat in New Zealand. I have been a performance artist at Burning Man. I have traveled to over 130 countries.

There have been large ups and downs. There were multiple times when my businesses were close to failure. There was a time during my divorce when my personal life was a disaster from which I thought I would never recover.

Now I divided my time between my apartment in Pacific Heights, my villa in Provence and travel. I have a network of friends around the world including artists, actors, architects, photographers, dancers, leaders in business, government, and nonprofit.

UC Berkeley Alumni Biography

Daniel Finnegan (1973)

RetiredThe Berkeley Sociology Department gave me the freedom to do almost anything I wanted. I wrote my dissertation on the history of physics, studied statistics and the philosophy of science, and ignored mainstream sociology. After graduation I pursued a career as a statistician with minimal links to sociology. I have directed over 250 research projects with total budgets of over a $100 million. After completing my PhD I moved to Washington D.C. and served as director of statistical services for the US Treasury and as a senior advisor to the Office of the President. In 1985 I returned to the Bay Area and founded Quality Planning Corporation. Quality Planning provides risk assessment services to the insurance industry. I took a leave from Quality Planning in 1989 to serve on the US Senate staff assisting with passage of the Americans with Disabilities Act. I have conducted a wide variety of major disability rights related studies for the Senate, the Office for Civil Rights, Department of Labor, National Science Foundation, and the Department of Health and Human Services. Collectively these studies have helped advanced this important movement. I have developed cost management and fraud control systems for the Department of Treasury, Medicare, Medicaid, the Department of Education, Social Security and numerous insurance companies. These systems have produced audited savings of many billions of dollars. In 2008 I sold Quality Planning and retired to Provence and New York City. Showing true diversity, the Berkeley Sociology Department even produced a capitalist.

Insurance Conference Bio 2005

Daniel Finnegan is President of both ISO Innovative Analytics, and Quality Planning Corporation, both .ISO companies. Dr Finnegan has over twenty-five years of professional experience in the design and implementation of loss prediction and control systems within both the insurance industry and the Federal Government. The results of Dr. Finnegan’s efforts currently produce audited savings in excess a billion dollars annually.

In addition to major private insurers, his clients have included the Internal Revenue Service, Social Security Disability Insurance, Medicare, Medicaid, the Executive Office of the President, and the United States Senate.

Daniel L. Finnegan, PhD

President, Quality Planning Corporation

Dr. Finnegan is an applied statistician with nearly two decades of high-level professional experience in the design and implementation of cost and fraud management systems. He has conducted over $70 million in research and development projects for cost and fraud control in the nation’s major private and public insurance programs. Control systems he has designed are currently in use at over 10,000 locations worldwide and are producing documented savings of more than $550 million annually.

Recent engagements to the private insurance industry include: Underwriting

- Directed rating error reviews for ——

- Re-engineered underwriting process for a major carrier to reduce rating error. Within three years total premium lost to rating error fell from over 10 percent to under 1 percent.

- Directed re-underwriting of over 250,000 auto policies producing savings in over $20,000,000 annually.

- Design and implementation of an automated re-underwriting system that identifies policy rating errors.

- Designed targeting system for workers’ compensation premium audits

- Participation in the development of the personal auto actuarial database used by leading California carriers to create Proposition 103-mandated rating plans.

- Database crosschecks to detect premium avoidance for WC policies.

- Developed an automated insurance application system that performed underwriting verifications during the application process.

- Developed monitoring system to control underwriting and rating errors by sales agents.

- Development of Compliance, an actuarial support software package.

Claims

- Keynote speaker for the National Association of Attorney Generals conference on insurance fraud.

- Development and training of a special investigation unit that targets organized fraud gangs.

- Development of an auto pre-inspection program.

- Financial audit of vehicle salvage operations.

- Development of a statistical targeting system provided early identification of claims likely to be fraudulent.

- Operational audits of motorist and motor vehicle licensing functions.

- Evaluated new and used part purchasing program.

- Built pattern analysis system for evaluation of medical bills for possible fraud.

- Assisted in setup of specialized claim unit for handling complex head trauma cases.

- Directed benchmarking study of comparative costs in body injury claims.

- Evaluation of telephone claims handling operations

- Keynote speaker for international conference on fraud control.

- Evaluation of experimental test of alternative medical programs for treating whiplash injuries.

- Installed and evaluated telephone scripting procedures to deter fraudulent claims before they occur.

- Developed and maintained automated new business rating audit program

- Benchmark analysis of time of disability periods for workers compensation.

- Fraud control training for over 700 adjusters and claims supervisors representing 55 insurance companies.

- Co-author of an adjusters’ manual on procedures for the identification and handling of fraudulent and exaggerated claims, adopted nationally by one of the nation’s largest carriers.

- Cost-benefit analysis of alternative methods of reviewing medical bills for fraud and exaggeration.

- Training adjusters to identify and resist claim fraud and exaggeration in auto BI medical bills.

- Development of standard claim letters and other communications designed to deter fraud.

- Development of the nation’s first fraud monitoring system designed to track the type, number and distribution of potentially fraudulent claims.

- Programming and maintaining a database of health care providers sanctioned for fraud and misconduct by the federal government.

- Procedural reviews of sales and underwriting operations to identify methods for reducing rating factor misreporting and error.

- Training adjusters on procedures for the identification and control of potentially fraudulent worker’s compensation claims.

- Membership on the California DOI advisory panel preparing state anti-fraud regulations.

- Fraud vulnerability assessments in auto claims, worker’s compensation underwriting, and personal lines underwriting for three major national insurers.

- Technical support for the preparation of a state-mandated fraud plan.

- A resource budgeting workshop for claim managers, designed to optimize the allocation of claim adjustment and investigation resources.

- Design of a training program for adjusters to recognize staged-accidents and other types of fraud.

- Cost-effectiveness analysis of a Special Investigation Unit.

- Conducting a national series of training seminars for senior insurance executives on fraud control.

- Analyze auto claim data and estimate potential savings from increased SIU investigations for a State Attorney General.

- Design and programming an auto underwriting system that verifies reported rating factors.

- Development of statistical WC claim reserving procedures

- Evaluated deterrence effects of fraud prosecutions.

- Cost-benefit analysis of use of private investigators.

- Fraud vulnerability analysis of claim payment system.

- Pattern analysis for detection of fraudulent collusion of adjusters and claims vendors.

- Evaluation of program to control bodily injury claim costs from minimum damage claims.

- Pattern analysis for detecting fraud in commercial auto claims.

- Example Federal and State fraud control engagements:Member, national blue ribbon panel, for fraud control in Medicare and Medicaid

- Statistical support on error reduction for the Internal Revenue Service.

- Development of an artificial intelligence system to detect errors in Social Security Disability Insurance benefit determinations. Simulations of the system anticipated initial savings of $120,000 a day, with increasing savings as the system “learns” from experience.

- Statistical support for the national Food Stamp/Medicaid/AFDC Integrated Quality Control System, the Federal government’s major fraud monitoring system in the social insurance programs.

- Design and evaluation of the financial management systems for the $27 billion Guaranteed Student Loan Program to prevent loan defaults and to collect defaulted loans.

- Design of a quality assurance system to reduce fraud, waste, and abuse in the $5.5 billion a year School Meals Program. Adoption of the project’s recommendations have resulted in savings to the government of over $150 million a year.

- National audit samples of over 4,000 recipients of the WIC Nutrition and TEFAP Programs.

- Design and implementation of the National Food Stamp Fraud Control Store Monitoring System.

- Cost-benefit analysis of 150 alternative computerized welfare fraud control systems.

- National training for State Fraud Monitors for federal health and nutrition programs.

- Development of background check and credit underwriting procedures to minimize defaults in Small Business Administration programs.

- Development of audit and program review manuals for the Office of Human Development Services and the Department of Education.

- Implementation of a program to minimize bad loan losses for the Economic Development Administration.

- Panel Member for Health Care Finance Administration expert panel on systems integrity.

- Panel Member for General Accounting Office expert panel on standards for federal claims payment systems.

Additional clients for statistical and fraud control services include:

- The Executive Office of the President;

- The States of California, Michigan, Maryland, Louisiana, Alabama, North Carolina, Vermont, Ohio, Oklahoma, Massachusetts and Washington;

- The United States Senate;

- The United States Departments of the Treasury, Commerce, Education, Health and Human Services, Labor, Housing and Urban Development, and Agriculture;

- 21st Century, AAA of Northern California, AAA of Southern California, Aetna, Allstate, American Re, Amica, Cal Casualty, Citation, Farmers, ICBC, Infinity, National General, Nationwide, Progressive, Prudential, Qestrel, Royal, Sequoia, Sterling, TIG, Unicare, USAA, Western Pioneer, and WCB

- National Science Foundation, Public Health Service, National Center on Child Abuse and Neglect.

- United States Court of Appeals for the Ninth Circuit;

- Coopers & Lybrand, PDA, Institute for Research in Social Behavior, Abt Associates, Analytic Systems, Evaluation Research Corporation, Invicare Corporation, Macro Associates, Science Applications International, Berkeley Planning Associates, and Advanced Technology; and

- Lawrence Hall of Science, National Institute on Drug Abuse, Women’s Educational Equity Fund, Disability Rights Education and Defense Fund, Center for Independent Living, Institute of Urban and Regional Development, Institute of International Studies

Employment and Education History:

1999-Present President and Chairman, Decision Integrity, San Francisco CA

1985-Present President, Quality Planning Corporation, San Francisco CA

(1993) Founding Director, Qestrel Claims Management, Oakland CA

(1989) Senior Professional Staff, United States Senate. As a public service, Dr. Finnegan took a leave of absence from Quality Planning to direct the cost and impact analysis of the Americans with Disabilities Act.

1980-1985 Director, Quality Assurance Division, Applied Management Sciences, Silver Spring MD.

1977-1979 Management Analyst, University of California at Berkeley.

1977-1978 Project Director, Lawrence Hall of Science.

1975-1978 Instructor, Lecturer, Department of Sociology, University of California at Berkeley.

Taught introductory, intermediate, and advanced social statistics and the graduate survey research methods course sequence.

1978 Ph.D., Sociology University of California at Berkeley

Advanced certifications in :

Applied Statistics

Survey Research

1975 M.A., Sociology University of California at Berkeley

1973 B.A., Sociology University of California at Berkeley

National College Extemporaneous Speaking Champion, 1968.

Systems Developed

IFQS: Integrated Fraud Query System for the Insurance Corporation of British Columbia (2001)

RAMS: Renewal Audit Management System for California State Automobile Association (1999)

STARS: Sampling, Tracking, Auditing, and Reporting System for California State Automobile Association (1998)

Qest: Claims management system for Qestrel Claims Management (1994)

Mileage Calculator: Underwriting technical support software for auto insurance rating (1998).

Comply: Actuarial Software for various clients (1991)

VIPER: Fraud investigation targeting and investigator resource management system for national food stamp program (1986).

PAS-PORT: Program Assess System for public health programs in Louisiana; later adopted by other states (1987).

IAS: Integrated Application System for auto and homeowners insurance application, quoting, and underwriting for the Southern California Automobile Club.

Application Review System: New business underwriting review system for the Southern California Automobile Club.

BISFU Monitor: Bodily Injury Special Fraud Unit productivity and savings estimation system for the Insurance Corporation of British Columbia.

MDSFU Montior: Material Damage Special Fraud Unit productivity and savings estimation system for the Insurance Corporation of British Columbia.

Example Publications and Invited Presentations:

May, 2000 “Auto Insurance Pricing Crisis” Senior Management Seminar, Hartford Insurance

May, 2000 “E-Business in Insurance” Training Seminar, Insurance Regulatory Examiners Society, National Association of Insurance Commissioners

January 2000 “How to Control Premium Leakage” Underwriting Trends Volume 12 # 1 January 2000

December 1999 “The Virtual Insurance Company” Annual Conference, National Association of Insurance Commissioners

May 1999 “The Virtual Insurance Company” Faculty, National Association of Independent Insurers Underwriting Seminar.

October 1998 “Detering Fraud” Keynote Speaker, International Insurance Fraud Conference, Vancouver, CA

October 1998 Insurance Fraud Interviews, CBC radio and BC TV

April 1998 “Link Analysis” Interview in Claims Magazine.

May 1993 “Law Enforcement Responses to Insurance Fraud;” Keynote Speaker, National

Association of Attorney Generals, Insurance Law & Policy Developments Seminar.

March1993 “Measuring and Monitoring Insurance Fraud” Speaker, Pacific Insurance and Surety Conference.

March 1993 “Defeating Claim Fraud,” Speaker, Annual International Auto Physical Damage

Conference.

November 1992 “How Do You Handle Unfair and Deceptive Practices?” Speaker, Rate Rollbacks

and Insurance Regulation Conference.

August, 1992 “Bad Faith vs. Big Fraud,” Keynote speaker with Gail Simpson, Claims Handling in

the 1990’s Conference

June 1992 “Identifying and Handling Potentially Fraudulent Bodily injury Claims” with Gail

Simpson, Allstate Insurance Manual.

May 1992 “Winning the Fraud Game: Part II” Best’s Review Volume 93 1.

April 1992 “Winning the Fraud Game: Part I” Best’s Review Volume92 12

February 1992 “Blatant Fraud Pushing Up the Cost of Car Insurance” Interview, New York Times.

Letter to Imperial House condo board

Daniel was born in Ohio and moved to California in elementary school. He graduated from Berkeley in 1972 where he earned his MA and Ph.D. After briefly teaching statistics and research methods at Berkeley, he moved to Washington, DC in 1980 where he conducted policy and financial analysis for the Federal Government, including directing statistical support services for the Treasury and serving as a senior advisor for financial management to the Office of the President. In 1985, he returned to the Bay Area and founded Quality Planning Corporation, a company which provided risk analysis and fraud detection services to the insurance industry. In 2004, Quality Planning was sold to the Insurance Services Office, a leading insurance rating agency and Daniel retired in 2007

Feb 14 2017

Autobiographies

In my life I have written several short autobiographies . Three were school related; one for high school creative writing, one for entry into Long Beach State College, and one for transfer to UC Santa Barbara. I have only the draft copies of these. I also presented myself through my resume and several bio’s for conferences and web sites.

High School Creative Writing Bio

Long Beach State Application Drafts

Santa Barbara Bio

Fantasy Version of Self

I am recording a version of the summary story I tell myself about myself. This version was mentally written in advance of my 50th high school reunion. I will not recite this to anyone but myself:

After high school I left a great need to be going. I had to be out of my parents home, I had to be out of Lodi. I saw so many opportunities in the world: the counter culture movement, the anti-war movement, women, travel, invention of a whole new self. That great urge to be going has served me well.

I have lived in black American ghettos, in a tower overlooking Hong Kong, in a penthouse on San Francisco’s Nob Hill, in a Buddhist monastery in Thailand, in a renaissance villa in Provence.

I have worked as a farm laborer, as a janitor, as member of the graduate faculty of UC Berkeley, as a senior advisor to the Office of the President, and as the founder and president of three successful technology firms. I have been at home cutting deals with venture capitalists, delivering keynote speeches at international conferences, teaching advanced seminars on mathematical modeling, attending the opera in Vienna, and taking a local bus across Rwanda. I have been very poor and very rich.

I have made love to beautiful women, married, raised a family, and am now a doting grandfather. I have a close and loving marriage and family.

I have made a difference in the world. I have invented new technologies and mathematics. I have tracked-down criminal gangs from Vancouver to Saigon. I have saved American taxpayers and insurance policy holders billions of dollars from preventing and defeating fraud. I played a key role in facilitating the passage of the Americans with Disabilities act thereby improving the lives of millions. I have founded businesses and created good jobs.

I have experienced life. I have ballooned over the Alps, trekked the glaciers of Patagonia and the sand dunes of Namibia, tracked leopards in Botswana, sailed the lesser Sunday islands and an America’s Cup class boat in New Zealand. I have been a performance artist at Burning Man. I have traveled to over 130 countries.

There have been large ups and downs. There were multiple times when my businesses were close to failure. There was a time during my divorce when my personal life was a disaster from which I thought I would never recover.

Now I divided my time between my apartment in Pacific Heights, my villa in Provence and travel. I have a network of friends around the world including artists, actors, architects, photographers, dancers, leaders in business, government, and nonprofit.

UC Berkeley Alumni Biography

Daniel Finnegan (1973)

RetiredThe Berkeley Sociology Department gave me the freedom to do almost anything I wanted. I wrote my dissertation on the history of physics, studied statistics and the philosophy of science, and ignored mainstream sociology. After graduation I pursued a career as a statistician with minimal links to sociology. I have directed over 250 research projects with total budgets of over a $100 million. After completing my PhD I moved to Washington D.C. and served as director of statistical services for the US Treasury and as a senior advisor to the Office of the President. In 1985 I returned to the Bay Area and founded Quality Planning Corporation. Quality Planning provides risk assessment services to the insurance industry. I took a leave from Quality Planning in 1989 to serve on the US Senate staff assisting with passage of the Americans with Disabilities Act. I have conducted a wide variety of major disability rights related studies for the Senate, the Office for Civil Rights, Department of Labor, National Science Foundation, and the Department of Health and Human Services. Collectively these studies have helped advanced this important movement. I have developed cost management and fraud control systems for the Department of Treasury, Medicare, Medicaid, the Department of Education, Social Security and numerous insurance companies. These systems have produced audited savings of many billions of dollars. In 2008 I sold Quality Planning and retired to Provence and New York City. Showing true diversity, the Berkeley Sociology Department even produced a capitalist.

Insurance Conference Bio 2005

Daniel Finnegan is President of both ISO Innovative Analytics, and Quality Planning Corporation, both .ISO companies. Dr Finnegan has over twenty-five years of professional experience in the design and implementation of loss prediction and control systems within both the insurance industry and the Federal Government. The results of Dr. Finnegan’s efforts currently produce audited savings in excess a billion dollars annually.

In addition to major private insurers, his clients have included the Internal Revenue Service, Social Security Disability Insurance, Medicare, Medicaid, the Executive Office of the President, and the United States Senate.

Daniel L. Finnegan, PhD

President, Quality Planning Corporation

Dr. Finnegan is an applied statistician with nearly two decades of high-level professional experience in the design and implementation of cost and fraud management systems. He has conducted over $70 million in research and development projects for cost and fraud control in the nation’s major private and public insurance programs. Control systems he has designed are currently in use at over 10,000 locations worldwide and are producing documented savings of more than $550 million annually.

Recent engagements to the private insurance industry include: Underwriting

Claims

Additional clients for statistical and fraud control services include:

Employment and Education History:

1999-Present President and Chairman, Decision Integrity, San Francisco CA

1985-Present President, Quality Planning Corporation, San Francisco CA

(1993) Founding Director, Qestrel Claims Management, Oakland CA

(1989) Senior Professional Staff, United States Senate. As a public service, Dr. Finnegan took a leave of absence from Quality Planning to direct the cost and impact analysis of the Americans with Disabilities Act.

1980-1985 Director, Quality Assurance Division, Applied Management Sciences, Silver Spring MD.

1977-1979 Management Analyst, University of California at Berkeley.

1977-1978 Project Director, Lawrence Hall of Science.

1975-1978 Instructor, Lecturer, Department of Sociology, University of California at Berkeley.

Taught introductory, intermediate, and advanced social statistics and the graduate survey research methods course sequence.

1978 Ph.D., Sociology University of California at Berkeley

Advanced certifications in :

Applied Statistics

Survey Research

1975 M.A., Sociology University of California at Berkeley

1973 B.A., Sociology University of California at Berkeley

National College Extemporaneous Speaking Champion, 1968.

Systems Developed

IFQS: Integrated Fraud Query System for the Insurance Corporation of British Columbia (2001)

RAMS: Renewal Audit Management System for California State Automobile Association (1999)

STARS: Sampling, Tracking, Auditing, and Reporting System for California State Automobile Association (1998)

Qest: Claims management system for Qestrel Claims Management (1994)

Mileage Calculator: Underwriting technical support software for auto insurance rating (1998).

Comply: Actuarial Software for various clients (1991)

VIPER: Fraud investigation targeting and investigator resource management system for national food stamp program (1986).

PAS-PORT: Program Assess System for public health programs in Louisiana; later adopted by other states (1987).

IAS: Integrated Application System for auto and homeowners insurance application, quoting, and underwriting for the Southern California Automobile Club.

Application Review System: New business underwriting review system for the Southern California Automobile Club.

BISFU Monitor: Bodily Injury Special Fraud Unit productivity and savings estimation system for the Insurance Corporation of British Columbia.

MDSFU Montior: Material Damage Special Fraud Unit productivity and savings estimation system for the Insurance Corporation of British Columbia.

Example Publications and Invited Presentations:

May, 2000 “Auto Insurance Pricing Crisis” Senior Management Seminar, Hartford Insurance

May, 2000 “E-Business in Insurance” Training Seminar, Insurance Regulatory Examiners Society, National Association of Insurance Commissioners

January 2000 “How to Control Premium Leakage” Underwriting Trends Volume 12 # 1 January 2000

December 1999 “The Virtual Insurance Company” Annual Conference, National Association of Insurance Commissioners

May 1999 “The Virtual Insurance Company” Faculty, National Association of Independent Insurers Underwriting Seminar.

October 1998 “Detering Fraud” Keynote Speaker, International Insurance Fraud Conference, Vancouver, CA

October 1998 Insurance Fraud Interviews, CBC radio and BC TV

April 1998 “Link Analysis” Interview in Claims Magazine.

May 1993 “Law Enforcement Responses to Insurance Fraud;” Keynote Speaker, National

Association of Attorney Generals, Insurance Law & Policy Developments Seminar.

March1993 “Measuring and Monitoring Insurance Fraud” Speaker, Pacific Insurance and Surety Conference.

March 1993 “Defeating Claim Fraud,” Speaker, Annual International Auto Physical Damage

Conference.

November 1992 “How Do You Handle Unfair and Deceptive Practices?” Speaker, Rate Rollbacks

and Insurance Regulation Conference.

August, 1992 “Bad Faith vs. Big Fraud,” Keynote speaker with Gail Simpson, Claims Handling in

the 1990’s Conference

June 1992 “Identifying and Handling Potentially Fraudulent Bodily injury Claims” with Gail

Simpson, Allstate Insurance Manual.

May 1992 “Winning the Fraud Game: Part II” Best’s Review Volume 93 1.

April 1992 “Winning the Fraud Game: Part I” Best’s Review Volume92 12

February 1992 “Blatant Fraud Pushing Up the Cost of Car Insurance” Interview, New York Times.

Letter to Imperial House condo board

Daniel was born in Ohio and moved to California in elementary school. He graduated from Berkeley in 1972 where he earned his MA and Ph.D. After briefly teaching statistics and research methods at Berkeley, he moved to Washington, DC in 1980 where he conducted policy and financial analysis for the Federal Government, including directing statistical support services for the Treasury and serving as a senior advisor for financial management to the Office of the President. In 1985, he returned to the Bay Area and founded Quality Planning Corporation, a company which provided risk analysis and fraud detection services to the insurance industry. In 2004, Quality Planning was sold to the Insurance Services Office, a leading insurance rating agency and Daniel retired in 2007

By Daniel • Visions